The entire real estate market as well as the demand for buying or selling real estate is generally influenced by the economic situation in the country. It has been developing very turbulently in Slovakia in recent years. We have had a difficult period marked by the global pandemic, the war in Ukraine and the subsequent radical interventions of the central banks. These have caused the crisis situations to ease, but at the same time, they are having a serious impact on the further development of prices and the economy as a whole. Although the property market came to a halt for a short time with the onset of the pandemic and the war, it always eventually picked up again and started to perform even better than before. However, the growth of completed deals had to slow down at some point and by the summer of 2022 we started to see a cooling of this activity.

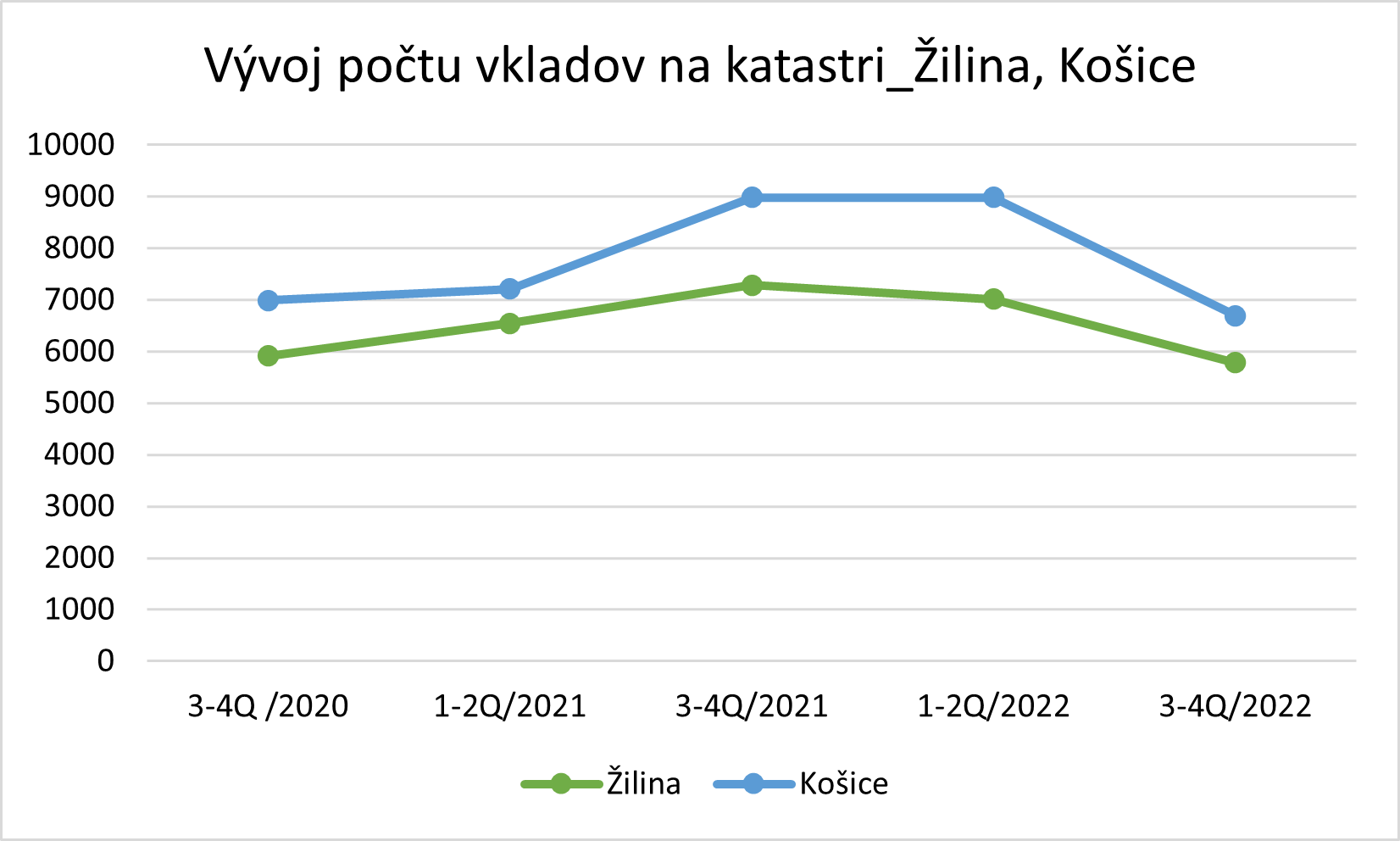

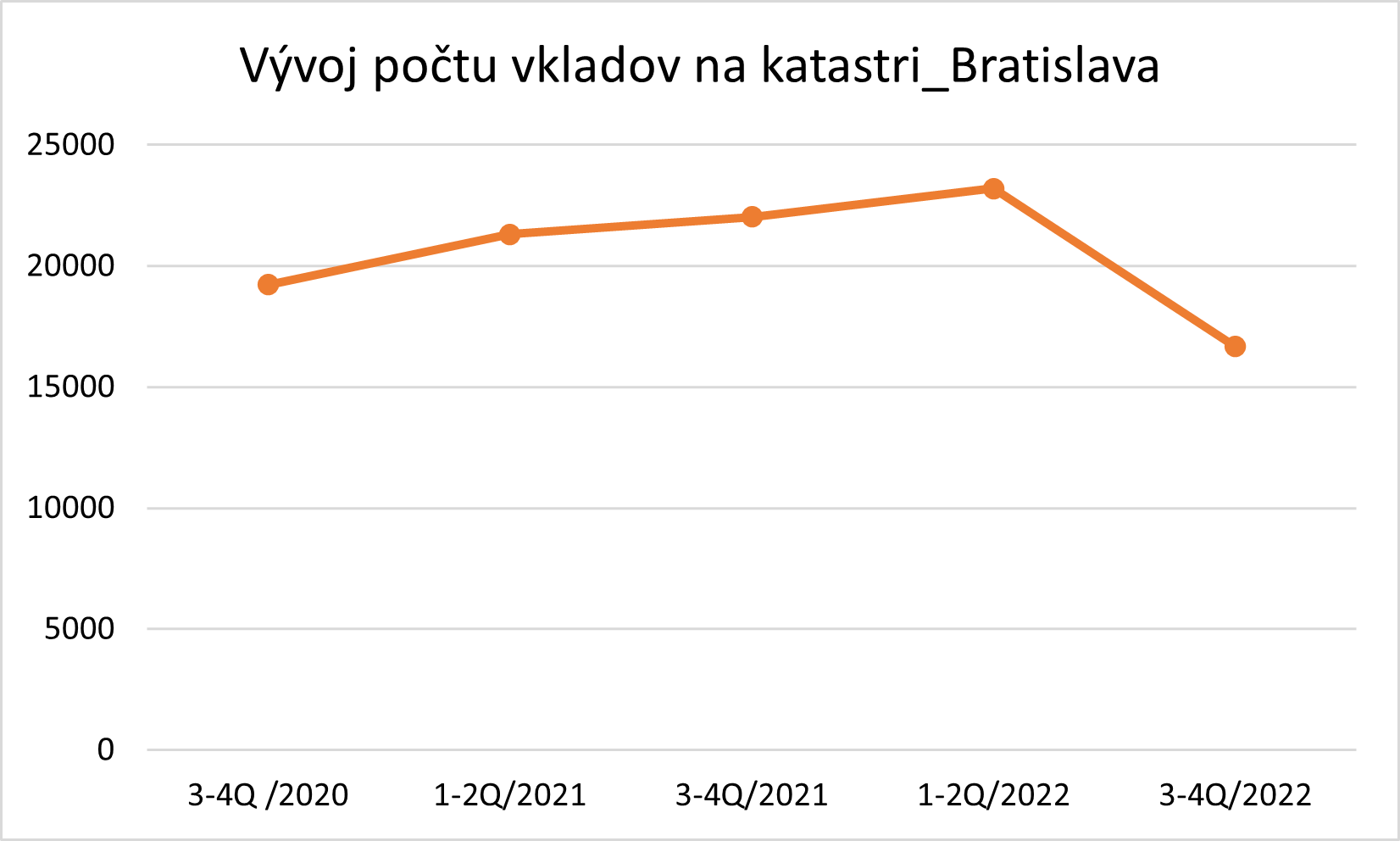

According to the data on the number of deposits on katasterportal.sk, the decline in real estate market activity developed as follows.

| 3-4Q /2020 | 1-2Q/2021 | 3-4Q/2021 | 1-2Q/2022 | 3-4Q/2022 | |

| Žilina | 5918 | 6548 | 7284 | 7015 | 5781 |

| Košice | 6991 | 7215 | 8987 | 8986 | 6694 |

| Bratislava | 19229 | 21306 | 22024 | 23196 | 16679 |

In each of the cities analysed, the number of stacked properties in H2 2022 is on a downward trend. The real estate market reached its peak at the end of 2021 and in the first half of 2022.

The biggest decline can be seen in Bratislava, where the volume of stacked properties decreased by more than 28% in the second half of 2022. In all three cities, the number of deposits has even fallen below the level that the market reached in 2020.

REASONS FOR THE DECLINE

There are more reasons for the decline of the real estate market.

The first decline was recorded in the summer. People, exhausted by pandemic-related measures, decided to go on holidays, enjoy the summer without restrictions and stopped in time to deal with housing problems. Upon their return, economic conditions no longer allowed a resumption of business.

The effects of inflation have begun to be felt in earnest, with rising prices for food and current services. The impact has been to make people less courageous about making changes to their housing. Income growth has not kept pace with the rise in the prices of essential products that households need, resulting in a reduction in the amount they are able to use each month to make their mortgage repayments.

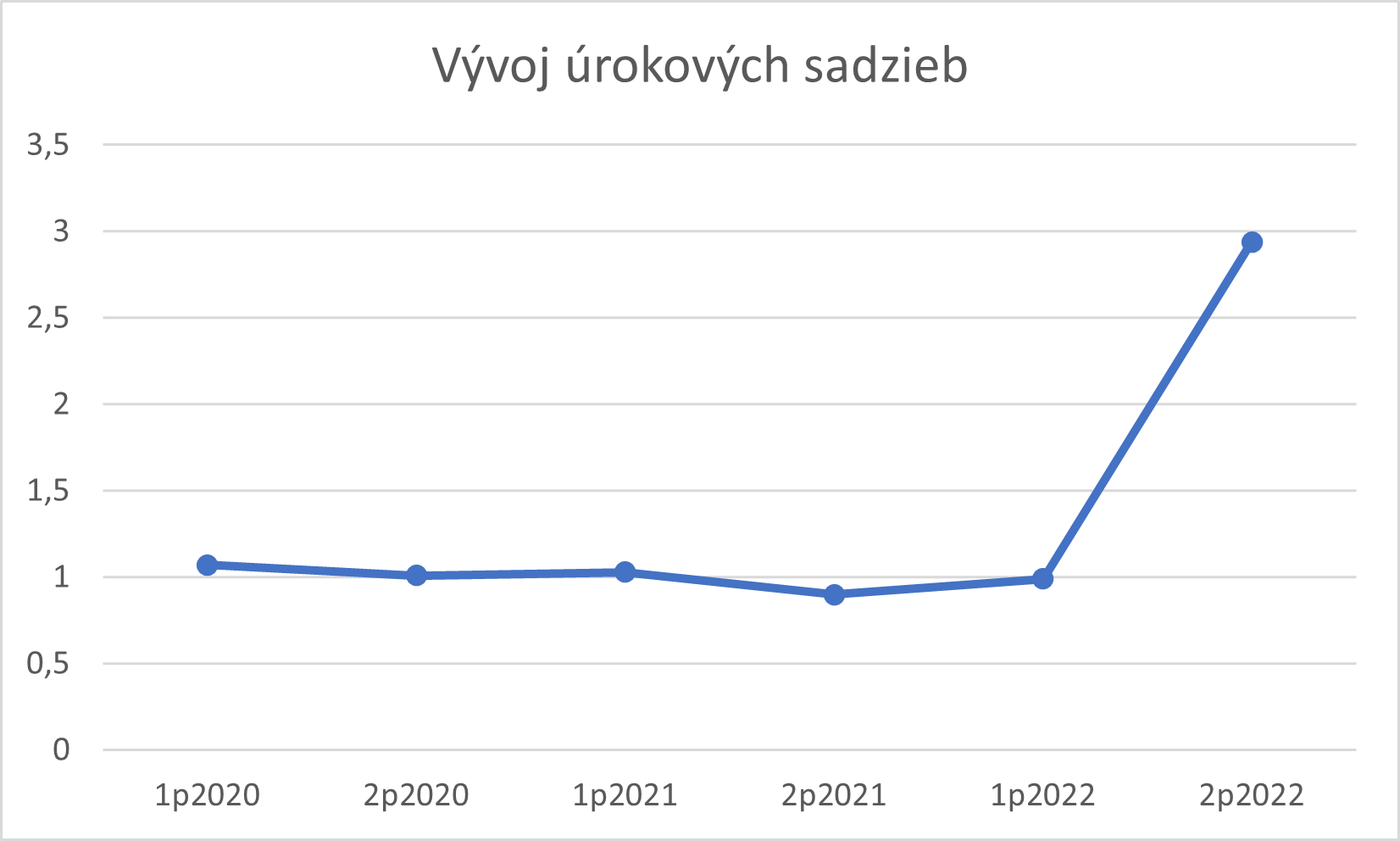

One of the main reasons is undoubtedly the development of interest rates, which today adversely affect the willingness and often the ability of the buyer to take out a mortgage loan. The majority of all properties sold are those for which the buyers took out mortgage loans, so we can conclude that the development of the number of deposits at the cadastre is directly related to the level of interest rates.

| 1-2Q/2020 | 2-3Q/2020 | 1-2Q/2021 | 3-4Q/2021 | 1-2Q/2022 | 3-4Q/2022 |

| 1,07 | 1,01 | 1,03 | 0,9 | 0,99 | 2,94 |

In 2020, the average interest rate was 1.07% and was still falling by March 2022. For November 2022, the National Bank of Slovakia puts the interest rate at 2.94%.

What do I expect next?

Regardless of the above-mentioned factors in the development of the real estate market, the good news is that the need for housing remains. Nor has the need to sell and acquire property disappeared. For the time being, the real estate market is coping with the situation by falling prices. However, this decline does not apply to new-build properties, which do not have much room for price reductions. The price of construction production has risen so much that developers would have to sell properties without their margin, which would lose business sense.

But there are situations in which people are forced to sell their properties even at reduced prices – the need to deal with inheritance, divorce or to provide replacement housing for their growing family. These situations keep the real estate market active, which will eventually kick-start further trading by clients who have postponed their decisions for a number of reasons for the time being.

I expect central banks to intervene again in time and reverse inflation along with rising interest rates. They will be forced to do so by the coming recession, which is just as liquidating for the economy. This process will be slow to cause a proper, steady onset of the economies and their recovery. The downturn in trading I expect will accompany the whole of 2023. By the end of the year, I believe the already deferred need to address housing will fade and the market will take off in a bolder direction.

What do I recommend?

I often get asked what to do, whether to buy, sell or wait. I encourage people to have the courage to address their needs as they arise. I understand that a seller who is about to get less money for their property today than they anticipated is wondering whether to wait until prices get higher again. However, I am a proponent of the view that if the money from the sale is going to buy the property again, then they will also buy it now at a lower price. In the end, he loses nothing. If he goes to use the funds in another way, rising inflation will make it possible to buy things cheaper today than in the future.

Meanwhile, the seller can still get a reasonable purchase price that will match the early 2022 price. If the tracking criterion were a comparison of prices at the turn of the calendar year, he would get the same, maximum purchase price today that could ever be realized in the market at the turn of 2021 and 2022.

As for buyers, despite the difficult situation, they have the opportunity to choose from a larger number of properties and find the dream house or apartment for themselves.